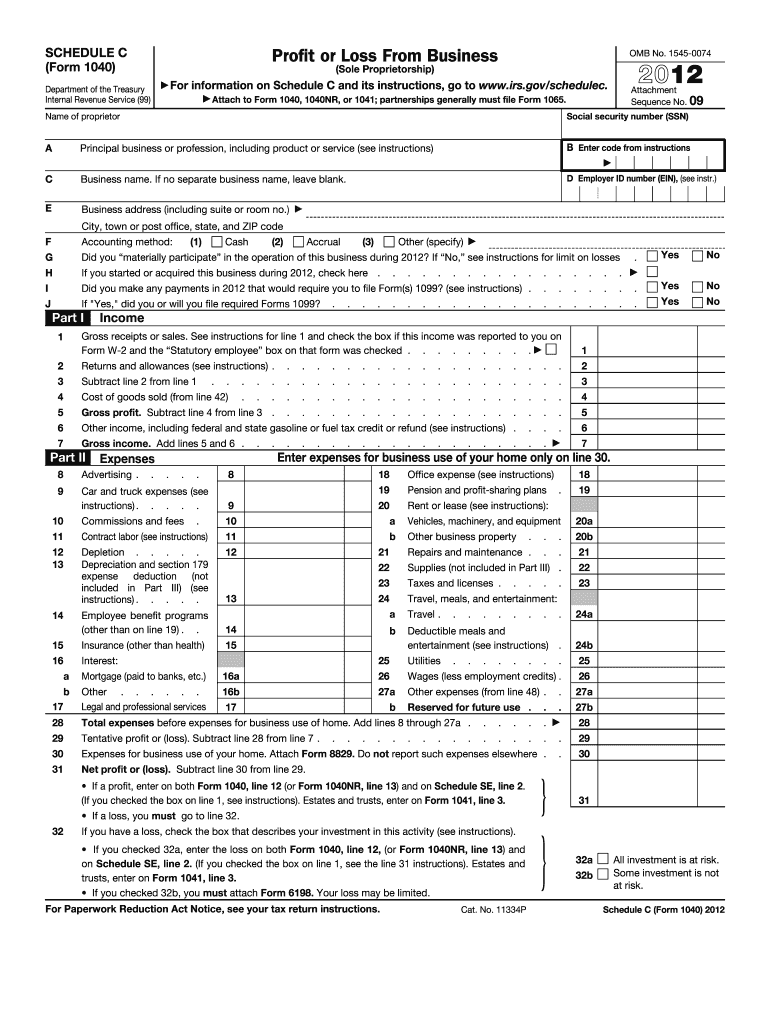

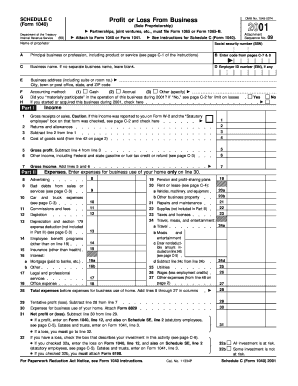

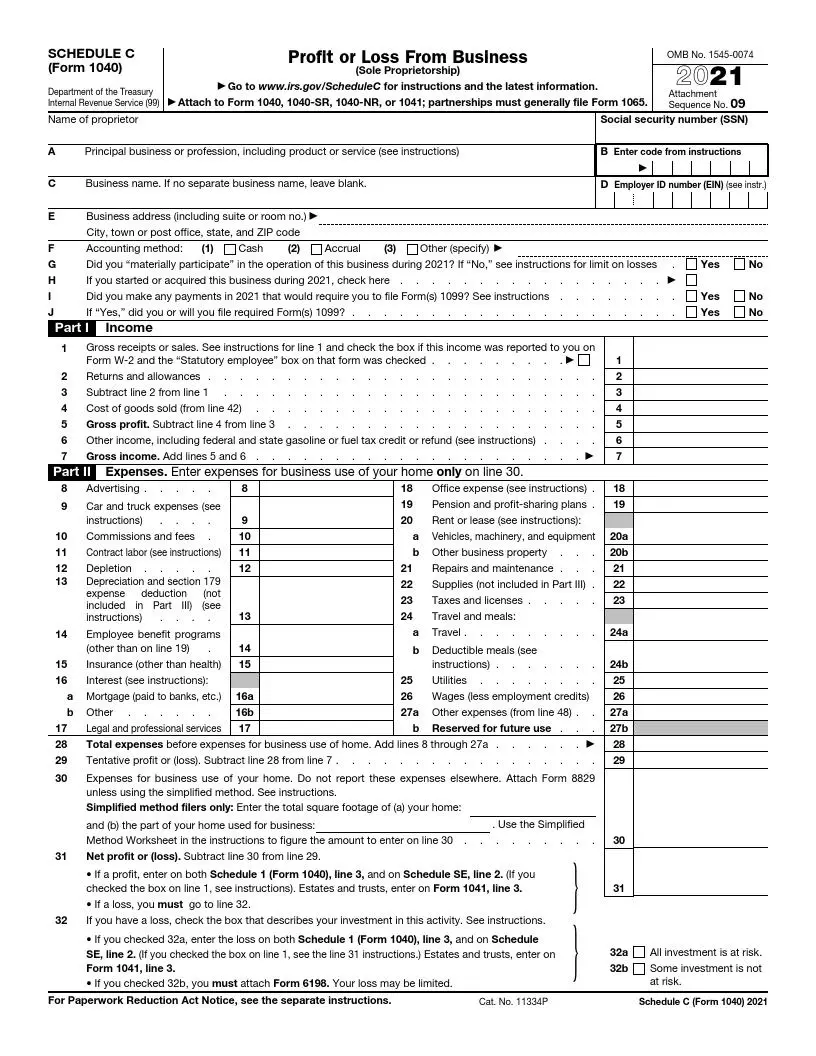

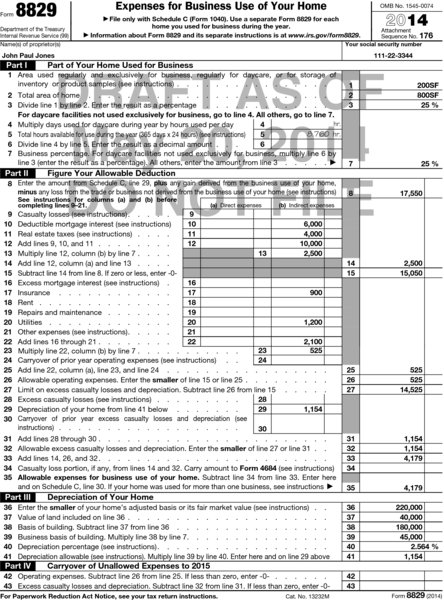

schedule c tax form example

You must send Form 1099-NEC to those whom you pay 600 or more. Follow the step-by-step instructions below to design your 2015 schedule c tax form.

Schedule C Pdf Fill Online Printable Fillable Blank Pdffiller

The first is to help you.

. He uses the cash method of accounting and files his return on a calendar year basis. Name of proprietor. This form can be used by an organization to calculate its profit and losses in accordance with the tax laws and then submit these to the taxation department.

Select the document you want to sign and click Upload. If you checked the box on line 1 see the line 31 instructions. The form is used as part of your personal tax return.

A Schedule C is a supplemental form that will be used with a Form 1040. Decide on what kind of. Schedule 1 Form 1040 or 1040-SR line 3 or.

A tax is imposed on a tax-option S corporation that has a recognized built-in gain. The first section of the Schedule C is reserved for your business information. Businesses that file Schedule C are pass-through entities meaning they pay tax using their owners Form 1040.

If you have a loss check the box that describes your investment in this activity. If you checked the box on line 1 see the line 31 instructions. For 2019 and beyond.

Up your record keeping to reflect each line on Schedule C Form 1040. Were going to review this in detail below. Go to line 32 31 32.

Schedule Q Additional Tax on Certain Built-In Gains. When filling out tax. Schedule C is a place to record the revenue from your business and all the costs associated with running your business.

As a sole proprietor money isnt taxed differently whether in. Schedule 1 Form 1040 line 3 and on. Follow the step-by-step instructions below to design your 2015 schedule c tax form.

If a loss you. These forms essentially serve two purposes. Estates and trusts enter on.

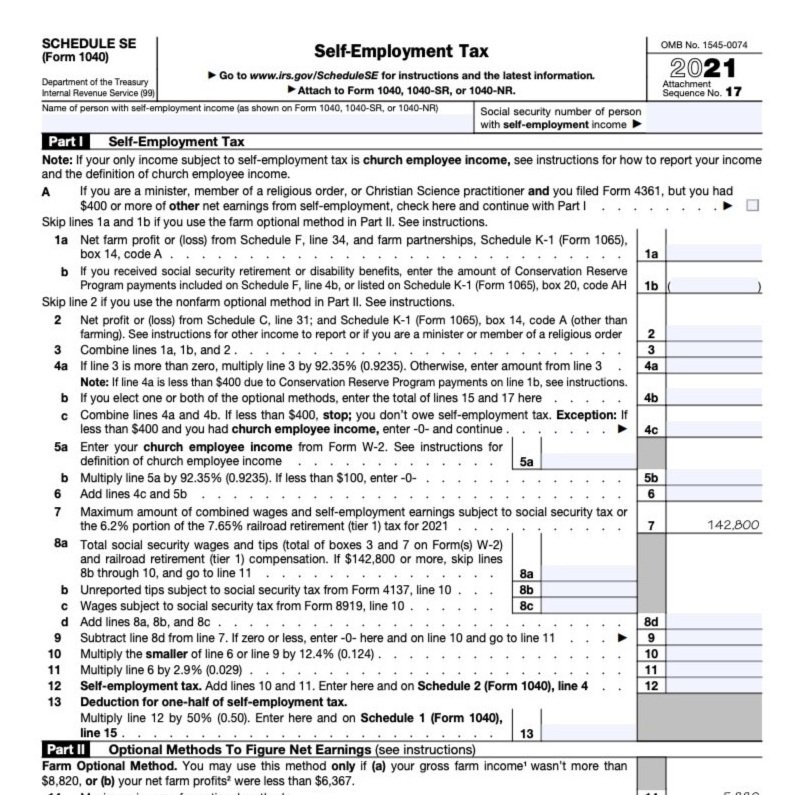

Schedule SE line 2. Form 1041 line 3. Schedule SE line 2.

The net profit or loss from this schedule is reported on. See instructions for Line 1 and check the box if this income was reported to you on Form W-2 and the statutory employee. The format followed is defined and.

IRS Schedule C Profit or Loss from Business is a tax form you file with your Form 1040 to report income and expenses for your business. Then select the activity that best identifies the principal source of your sales or receipts for example real estate agent. Form 1040-NR line 13 and on.

The IRS Schedule C form is the most common business income tax form for small business owners. If you checked 32a enter the. Now find the six-digit code assigned to this activity for example.

This form is known as a Profit or Loss from Business form. The resulting profit or loss is typically. Gross receipts or sales.

Frank Carter is a sole proprietor who owns and operates a fishing boat. Tax from Schedule 5S-ET on line 7 of Form 5S. It is used by the United States Internal Revenue Service for.

Payments to contractors freelancers or other small-business people can go on Line 11. Form 1041 line 3. Tax return schedules are tax forms you complete in addition to your return when you file.

Estates and trusts enter on. The Schedule C tax. If you checked 32b.

A Friendly Guide To Schedule C Tax Forms U S Freshbooks Blog

How To Fill Out Your Tax Return Like A Pro The New York Times

5 Printable Schedule C 1040 Form Templates Fillable Samples In Pdf Word To Download Pdffiller

How To Fill Out Your 2021 Schedule C With Example

How To Fill Out Your Schedule C Perfectly With Examples

How To Fill Out Your Schedule C Perfectly With Examples

113 Printable Form 1040 Templates Fillable Samples In Pdf Word To Download Pdffiller

Schedule C Ez Form 1040 Youtube

What Is Self Employment Tax And Schedule Se Stride Blog

1040 Schedule C Form Fill Out Irs Schedule C Tax Form 2021

Free 9 Sample Schedule C Forms In Pdf Ms Word

Bank Deposit Analysis Lisa The Tax Lady

Schedule C Form 1040 Sole Proprietor Independent Contractor Llc How To Fill Out Form Schedule C Youtube

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business

Self Employment Income How To File Schedule C

Free 9 Sample Schedule C Forms In Pdf Ms Word

Uber A Superlative Example Prosperity Now

Irs Schedule C Explained Youtube

Completing Form 1040 And The Foreign Earned Income Tax Worksheet